pros and cons list carbon tax

Many of the new carbon tax proposals use an emissions trading system as a primary form of income generation. List of Advantages of Carbon Tax 1.

27 Main Pros Cons Of Carbon Taxes E C

The tax rate on carbon products should be attaches to objective CO2 tonnage contributed to the atmosphere.

. List of the Pros of a Carbon Tax. CO2 taxes often apply when triggering thresholds get reached through mining production or fabrications activities. Proponents claim that a carbon tax would be the most cost-effective way to cut carbon-dioxide emissions.

When a carbon tax is implemented there are two potential benefits to consider with this legislation. The carbon tax is the most equitable method for carbon use to pay for its pollution. Companies have an incentive to go green as well.

The carbon tax revenues could be used to reduce income tax or payroll tax ratesa tax swap. Featuring 32 riders performing jaw-dropping tricks as they shred through rugged terrain across North America and Europe Burtons recent film One World is an epic celebration of snowboarding. To come up with a good opinion about this subject matter on our end it is best to look at its pros and cons.

The creation of carbon is a side effect of cost effective energy. The carbon tax creates an artificial economic market that isnt always sustainable. The system needs to be employed by law similar to other sin taxes on alcohol tobaccos and even sales taxes.

At a high level the primary advantage is the carbon tax will force companies to find alternative methods in their manufacturing processes by levying a tax that increases their cost. There is the possibility to experience a financial return for households who limit their fossil fuel consumption in the form of credits. ECO 2118 Lecture Notes - Carbon Tax Marginal Cost Specific Volume goldbuffalo515 ECO105Y1 Lecture Notes - Lecture 13.

Market Price Market Clearing Social Cost. When consumers are asked to pay more without holding businesses responsible for their involvement then this idea struggles to gain traction. Sustainable Living Taking Action from BANK OF THE WEST The Pros and Cons of Carbon Offsetting.

Solar panels wind turbines nuclear power plants and electric cars are no longer enough to mitigate the risks posed by human. People will adjust their consumption behavior. Unfortunately this would also create a major disadvantage as the carbon tax will most likely hurt.

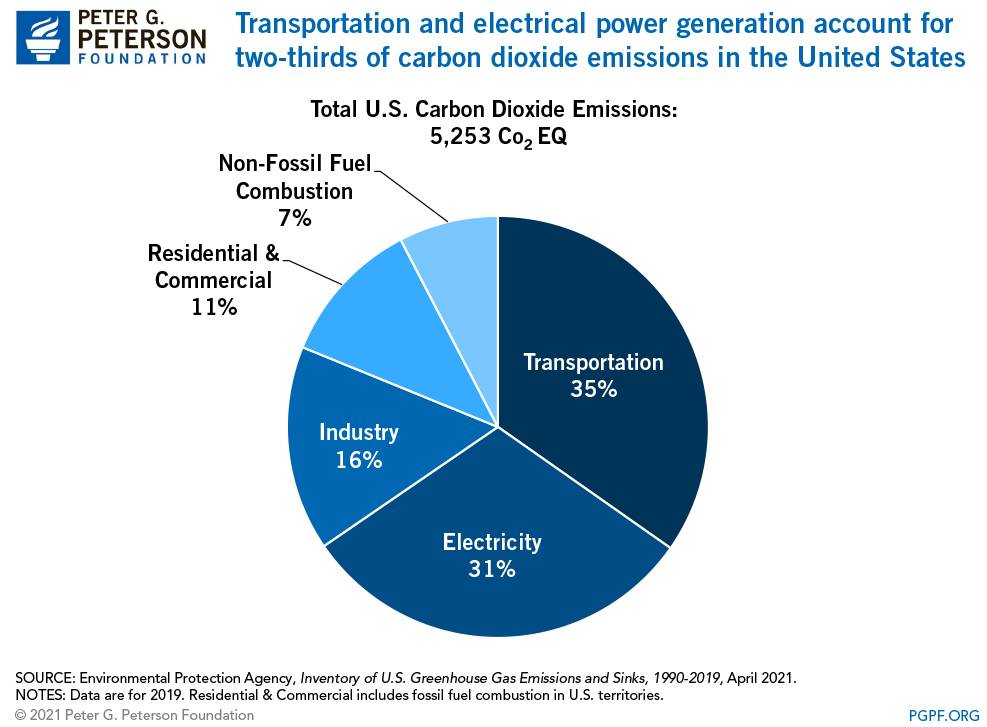

By taxing it not only would prices raise for the energy needs of consumers but there would be less overall energy consumed. She suggests that a carbon tax would reduce the buildup of greenhouse gasses replace. A carbon tax increases energy costs in proportion to the carbon content of the source of energy.

It would raise energy prices. A carbon tax is a specific price the government charges for carbon content per ton in fuels most proposals range from 15 to 30 per ton. He suggests that this should be given 100 as a dividend to the general public stating that the family with carbon footprint less than average makes money their dividend exceeds their tax.

For every 10 increase in price there is an estimated 3 decrease in consumption. It is easier and quicker for governments to implement. As Camila Thorndike the dynamic young leader of an effort to get a carbon price passed in Oregon told the Democrats at their platform hearings As a cross-sector and market-based solution a carbon tax empowers business to profitably transition to the clean-energy economy.

The latest iteration of the carbon tax is the carbon dividend plan which was endorsed last month by a group of Nobel-winning economists chairs of the Federal Reserve and two former Treasury secretaries. The Clinton administration tried and failed to impose a Btu tax on all forms of energy. Using the Revenues to Reduce Deficits Would Decrease.

As a leading sustainable brandand a company. The price of carbon dioxide emissions can be adjusted. It encourages people to find alternative.

Proponents claim that a carbon tax. The pros and cons of a carbon tax look at the reality of what occurs with this policy compared to its modeling. There are three big problems with the concept.

On account of the different carbon-intensity of fuels price impacts are most significant for energy produced with coal then petroleum then natural gas. A carbon tax also has one key advantage. Personal taxes would go down as costs of living went up offsetting the damage to the economy from a.

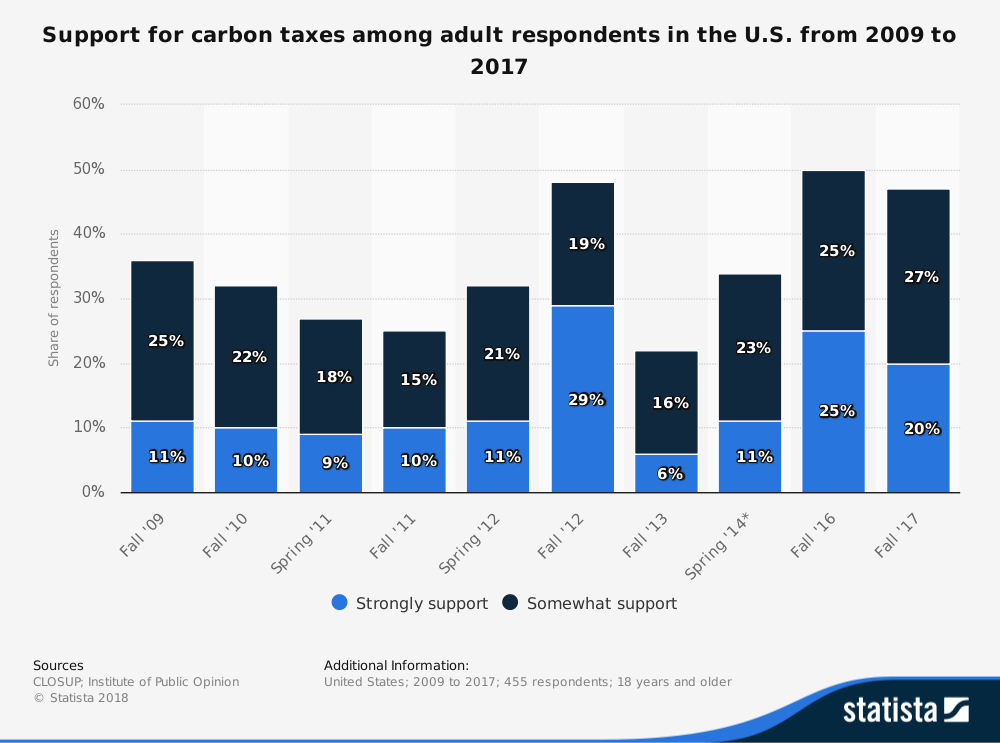

In relation to the US Hansen argues that we could set a carbon tax at US115 per ton of CO2. Some uses of those revenues could substantially offset the total economic costs result-ing from the tax itself whereas other uses would not. Up to 24 cash back Withal the positive intentions that this type of tax carries its idea still has garnered some criticisms leading to some heated debates around the world.

4 hours agoJohan Langerock policy adviser in the European Parliament discusses his visit to Washington DC the future of the OECD two-pillar tax plan and. Advantages of the Carbon Tax. The design of a carbon tax allows it to provide multiple benefits.

A carbon tax can be very simple. Carbon tax would help determine the taxs ultimate impact on the economy. But the carbon tax keeps running aground.

BY RP Siegel. However some differences exist. The horse-trading necessary to get a carbon tax passed might require all sorts of policy contortions.

That may sound a little wonky but she added that she and many. Voters have stopped two carbon tax initiatives since 2010 in Washington State for this very. Making energy more expensive might do this they caution.

Higher carbon tax rates cause larger changes in energy prices. Don Fullerton the Nannerl Keohane Distinguished Visiting Professor for Spring 2015. Pressure for a faster energy transition process increases.

This would result in tax revenue of 670 billion. There are quite a few pros and cons that need to be discussed. Both cap-and-trade programs and carbon taxes can work well as long as they are designed to provide a strong economic signal to switch to cleaner energy.

The voluntary carbon offset credit market has the potential to play a major role in allowing society to continue to emit greenhouse gases while striving to keep global warming under 15 degrees. Implementing a carbon tax is far from the no-brainer Harris and McAfee seem to believe and its impact is unlikely to do more than marginally accelerate a process that capitalist markets are already fueling. Adele Morris proposes a carbon tax as a new source of revenue that could also help address climate change.

The Pros and Cons of Taxing Climate Change. Further opponents point out that all taxes have distortionary effects affecting free-market decisions and perhaps reducing gross domestic product growth. Where the raised revenue would go depends on the various.

Political solutions to climate change are as every activist monitoring the COP negotiations should know by now largely ineffective. Higher incentive for people to avoid the use of fossil fuels. A climate change economist discusses effectiveness of a carbon tax.

Carbon Tax Pros And Cons Economics Help

Dreambikes Crankbrothers Com Ibis Mojo Hd Bicycle Bike Mt Bike Bike

Biomass Energy Is Produced From Organic Materials Which Come From Living Organisms Explore The Top 20 Biomass Energy Pros And Co Biomass Energy Biomass Energy

Carbon Tax Pros And Cons Economics Help

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Carbon Tax What Are The Pros And Cons Climateaction

A List Of Different Sustainable Farming Methods Practices Better Meets Reality Sustainable Farming Farm Crop Farming

Carbon Tax Pros And Cons Economics Help

Go Ahead And Give This A Read 50 Reasons To Date A Bartender Http Cocktailsandshots Tumblr Com Post 163717765318 Utm Campaign Cr Bartender Mortgage Dating

What Is A Carbon Tax How Would It Affect The Economy

2020 Mercedes Amg C63 Coupe Dashboard Photo Ganhar Dinheiro Na Internet

What Is Esg Investing And 5 Reasons Why It Is A Bad Idea Financial Freedom Countdown In 2021 Financial Freedom Investing Financial

Carbon Tax Pros And Cons Economics Help

Niner Air 9 Carbon Pricing Photos 1899 For Frame Mountain Bike Reviews Hardtail Mountain Bike Montain Bike

Niner Air 9 Carbon Fiber Hardtail Bike Hardtail Mountain Bike Bicycle Bike Ride

Household Battery Storage A Comparison Of Product Price Performance Battery Storage Storage Table Storage